News

-

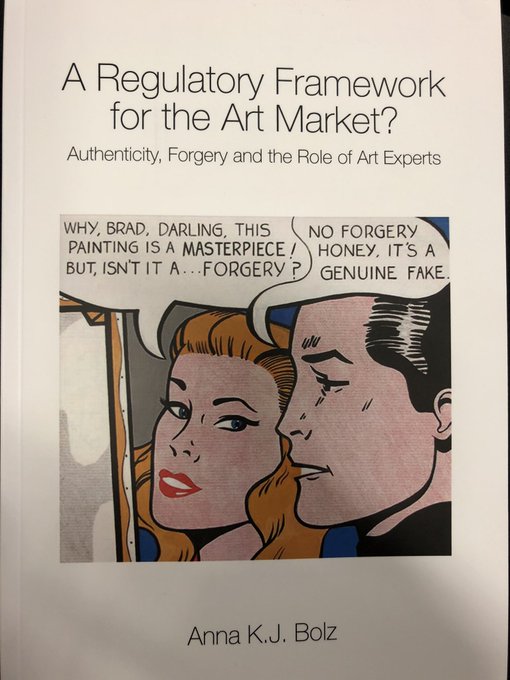

PhD thesis written by Anna Bolz. Authencity, forgery and the role of art experts. To a certain extent, the art market has been complicit in forgery schemes being successful. The peculiarities which distinguish the art market from other sectors are exactly thefeatures on which the business thrives...

-

As a visiting scholar at the Max Planck Institute for the History of Science in Berlin, Professor Karin Bijsterveld is eavesdropping on Stasi wiretaps and reading files in an attempt to understand how the organisation struggled with sounds, vaulting ambition and big data issues.

-

Rector Magnificus Rianne Letschert signed the San Francisco Declaration on Research Assessment (DORA) today, marking Maastricht University’s (UM) official endorsement of a new approach to assessing academics.

-

Raf De Bont, associate professor of history of sciences at Maastricht University, will receive the Dr Hendrik Muller Prize, an amount of 25,000 euros, for his innovative contribution to the history of science and the environment.

-

FASoS PhD Candidate Marloes de Hoon co-authored a report concerning migration and asylum permission holders.

-

Can she explain the second brain to children? For her discovery of the involvement of the Enteric Nervous System (ENS) in colorectal cancer, Veerle Melotte has been nominated for the Klokhuis Wetenschapsprijs. That might give her the chance to share her research – and possibly get a foot in the door...

-

The pilot project Web of Laws is working to develop tools that quickly filter the relevant rulings for lawyers—with FAIR data use and open science as important anchors.

-

Open Science is an international phenomenon that is increasingly taking concrete shape at Maastricht University (UM). Among its aims is the goal of making science ‘as open as possible’ and ‘as closed as necessary’.

-

PhD thesis written by Sieb Kingma. After the 2008 global financial crisis, the international tax landscape really changed. Intergovernmental organizations such as the G20, OECD and UN are working on a fundamental reform of the international tax regime to make multinational enterprises and rich...