ITEM publication about student mobility rights and national higher education autonomy in the European Union

The thesis ‘Balancing Student Mobility Rights and National Higher Education Autonomy in the European Union’ by Dr. Alexander Hoogenboom, connected to the Institute for Transnational and Euregional cross border cooperation and Mobility / ITEM and Faculty of Law of Maastricht University, will be issued by publishing house Brill in the series ‘Nijhoff Studies in European Union Law’ in October 2017.

The thesis addresses the recent tension around student mobility and tries to answer the overarching question on how to safeguard mobility rights for study purposes of Union citizens within the EU, while simultaneously ensuring the sustainability of the national higher education systems of (certain) Member States. The main conclusion in this regard is that the current EU legal framework applying to mobile students is both insufficient and incoherent. In addition, the Member States of the EU seem to have trouble properly implementing EU law in this area and cannot by themselves effectively and fairly engage in balancing exercise. Rather there is a need for a comprehensive and generous EU-level study loan system – managed centrally at the EU level - to support the mobility rights of Union citizens for study purposes.

Download the publication flyer here or pre-order the book on www.Brill.com.

Also read

-

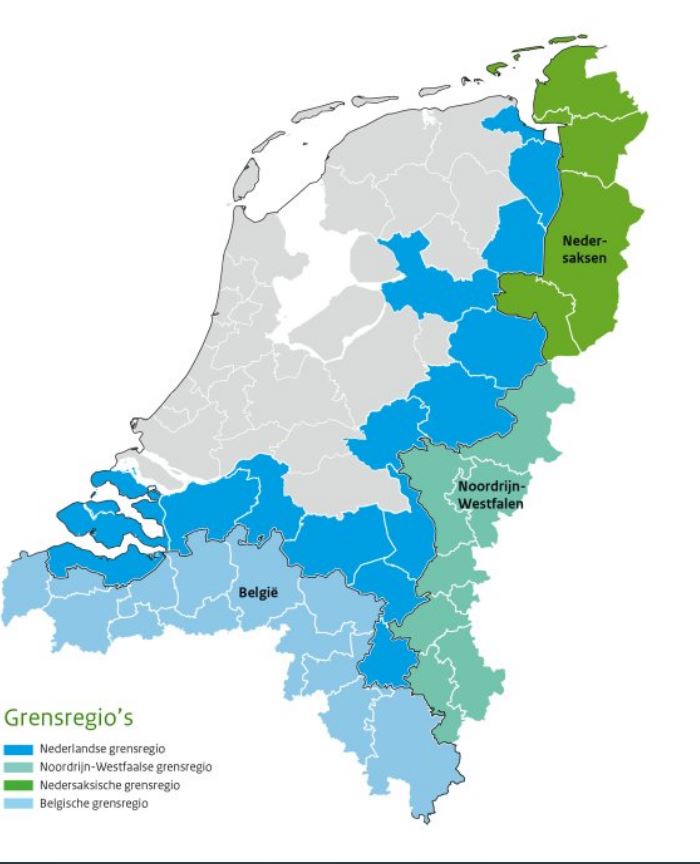

On Wednesday 15 March 2023, there will be elections in the Netherlands. We will then vote for the Provincial Council and the District Water Board. Seven of the 12 Dutch provinces border a neighbouring country. Cross-border cooperation and special attention for border regions is therefore extra...

-

The importance of cross-border cooperation manifests itself more than ever during the coronapandemic. Multi-level governance is the foundation for taking the next steps; looking for each other and perpetuating relationships at all levels, in administration, politics and practice. This became clear...

-

Unless the EU rules and tax treaties are amended, some cross-border workers will soon have to pay tax in two countries: in their country of residence for hours spent working from home, and in the country in which they work for hours spent in the office. Since COVID-19 has made working from home...